How it Works

Ownly Property makes it simple to become a property investor — without the high upfront costs or stress.

Our model gives you fractional ownership in a high-value property, while we handle everything from setup to management. Here’s how:

.png)

Step 1: Join The Joint Venture

You choose a live investment opportunity and invest from just $10,000 per share.

Each property has 90 shares available to investors. The other 10 shares (10%) are retained by Ownly in exchange for managing the full 10-year journey.

Each Ownly investment opportunity is structured as a standalone Joint Venture (JV) company, formed specifically to purchase and manage one individual property.

-

Investors become shareholders in the JV company

-

The JV owns the property outright (mortgage-free)

-

Ownly Property retains 10% ownership as compensation for ongoing management.

Step 2: Join The Joint Venture Buys The Property

Once all shares are filled, the JV company is formed and the property is purchased outright — no mortgage required.

Funds are held in escrow until settlement, adding an extra layer of security for all investors.

Step 3: Rental Income Grows Your Return

The property is rented out, and the net rental income is placed in a high-interest account, compounding over time.

There are no monthly payouts — all income is retained and reinvested to maximise end-of-term returns.

Step 4: Ownly Property Manages Everything

From tenants and maintenance to insurance and reporting, Ownly handles the day-to-day.

You get quarterly updates, full transparency, and no stress.

Step 5: Exit & Distribute

At the end of the 10-year fixed term, the property is sold and profits are distributed:

-

Capital growth from the property

-

Compounded rent from the high-interest account

-

Final returns paid out to all investors

You will also have the first option to reinvest in future Ownly properties.

Understanding the Ownly Property Joint Venture Model

Formation of the JV

-

A new Limited Liability Company is formed for each property (e.g., 33B Cedar JV Ltd).

-

Up to 90 shares are sold to investors for Between $10,000 - $12,000 each (depending on property value).

-

Ownly retains 10 shares (10%) in exchange for managing the asset over 10 years

-

The capital raised is used to purchase the property outright.

Legal & Financial Protections

-

Every investor is a legal shareholder in the JV — with shareholder rights

-

A Shareholders’ Agreement governs decision-making, transfers, and disputes

-

Funds are held in escrow until settlement for investor safety

-

The company maintains independent financial reporting and tax compliance

Ownly Property's Role

Ownly Property acts as the operating partner and project manager:

-

Property sourcing

-

Negotiation & due diligence

-

Tenant management

-

Repairs, insurance, and compliance

-

Financial administration

-

Quarterly investor reporting

-

Ownly receives no salary or commission — only its 10% equity stake

Key Benefits of Ownly Property Joint Venture Model

Full legal ownership - You own actual shares in the company that owns the property

No debt - The property is mortgage-free, reducing risk

Compounded rental income - Rent is held in high-interest accounts and paid at the end

Fixed 10-year term - No early exits = predictable and focused capital growth

Transparent reporting - Quarterly updates + end-of-year reports

Protection via shareholders’ agreement - Decisions require majority vote, shares are protected

Escrow-secured capital - Funds are only used once the JV is live

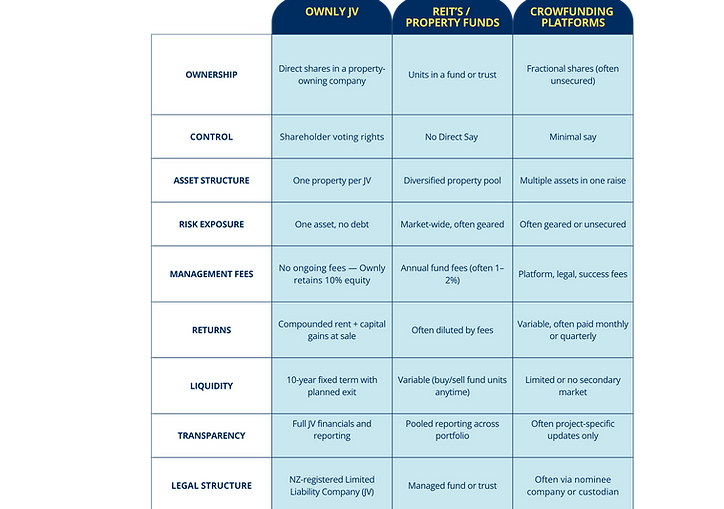

How Ownly Property Differs from Other Property Investment Models

.png)

Ready to Get Started?

With Ownly Property, you don’t need millions to invest — just a minimum of $10K and a desire to grow your wealth. Our proven model makes it simple, secure, and fully managed.

Shares are limited in each opportunity, and demand is growing fast. Don’t wait on the sidelines — take your first step toward smarter property investing today.

_edited.png)